Lead Change

ETF outflows hit $4B in five weeks. Mining difficulty jumped 15%. Bitcoin sits at $67,526. Miners are more bullish than markets.

Market Snapshot

BTC bounced but remains below the $79K True Market Mean flagged by Glassnode. ETH continues to underperform, and 56.6% BTC dominance tells you where conviction lives.

Narratives Snapshot

Two narratives are green in a sea of red: Prediction Markets (+6.39%) and Memes (+3.22%). Everything else is getting hammered.

What Prediction Markets Think

Prediction markets are cautiously constructive on BTC direction (63.5% say $80K before $60K) but deeply skeptical on relative performance: only 24.5% think Bitcoin beats silver this month. The positioning says "we think crypto survives, but traditional safe havens are winning the fear trade."

Data from Polymarket prediction markets • Prices reflect real-money bets

5 Changes That Matter

1 $4B in Bitcoin ETF outflows over five weeks. Another $166M walked out the door yesterday.

Five straight weeks of bleeding. That's not a blip, that's a pattern. The debate right now is whether this is a healthy reset (institutions rebalancing after a big run) or something uglier (structural demand drying up). Here's the thing most people miss: ETF outflows don't just remove capital. They remove the narrative. The "wall of institutional money" story was the single biggest bull case for 2025. When that wall starts crumbling, you don't just lose dollars. You lose the story that attracted the next round of dollars. Glassnode data shows BTC has broken below the ~$79K True Market Mean and is now stuck in a defensive range above the ~$54.9K Realized Price. That's not a comfortable neighborhood.

If ETF outflows slow to under $50M/day for 3 consecutive sessions, the reset thesis wins. If we see another $500M+ single-day outflow, the "structural weakness" camp gets louder. The line in the sand: BTC needs to reclaim $72,000 to confirm any bullish shift per options market pricing.

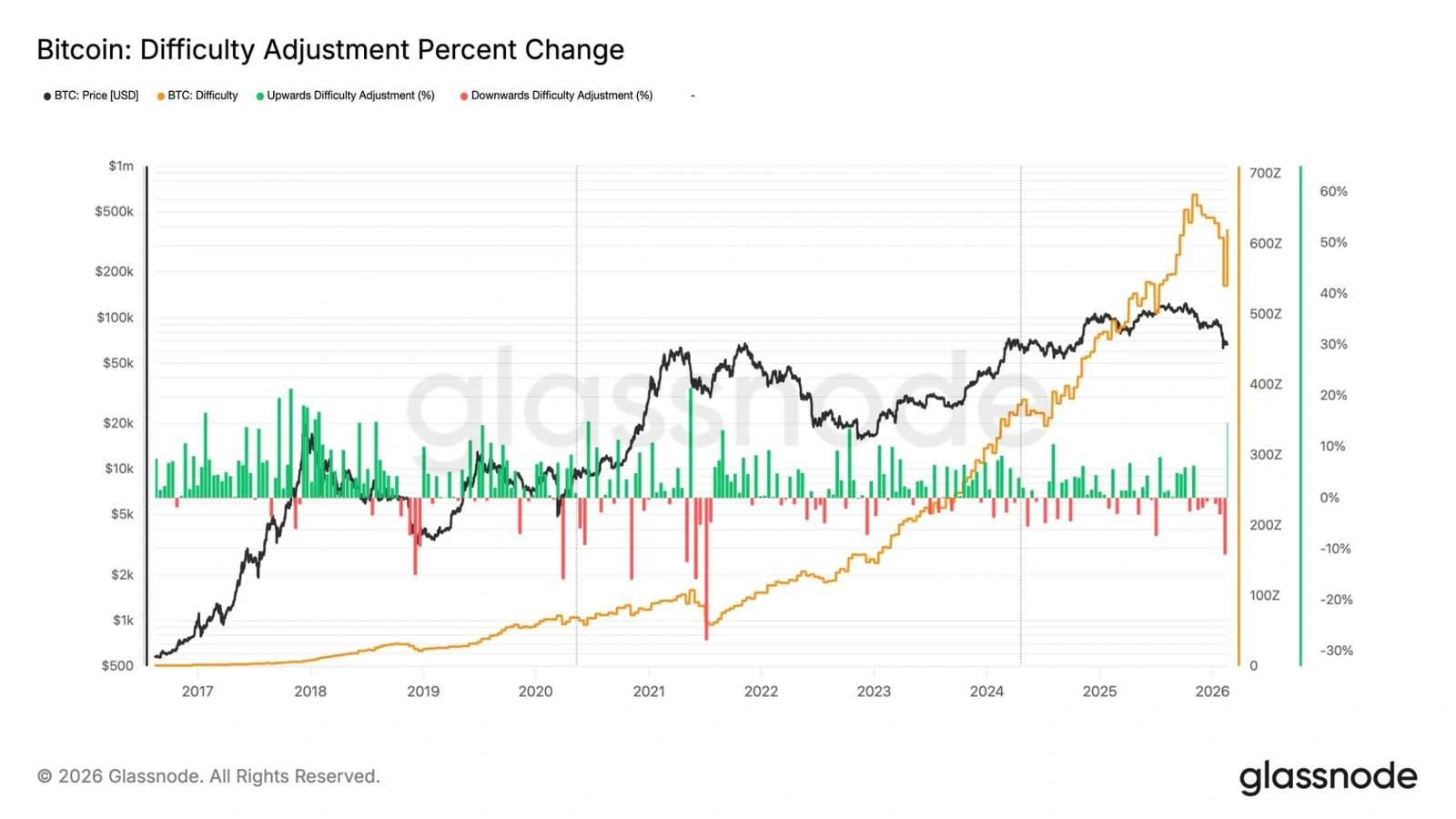

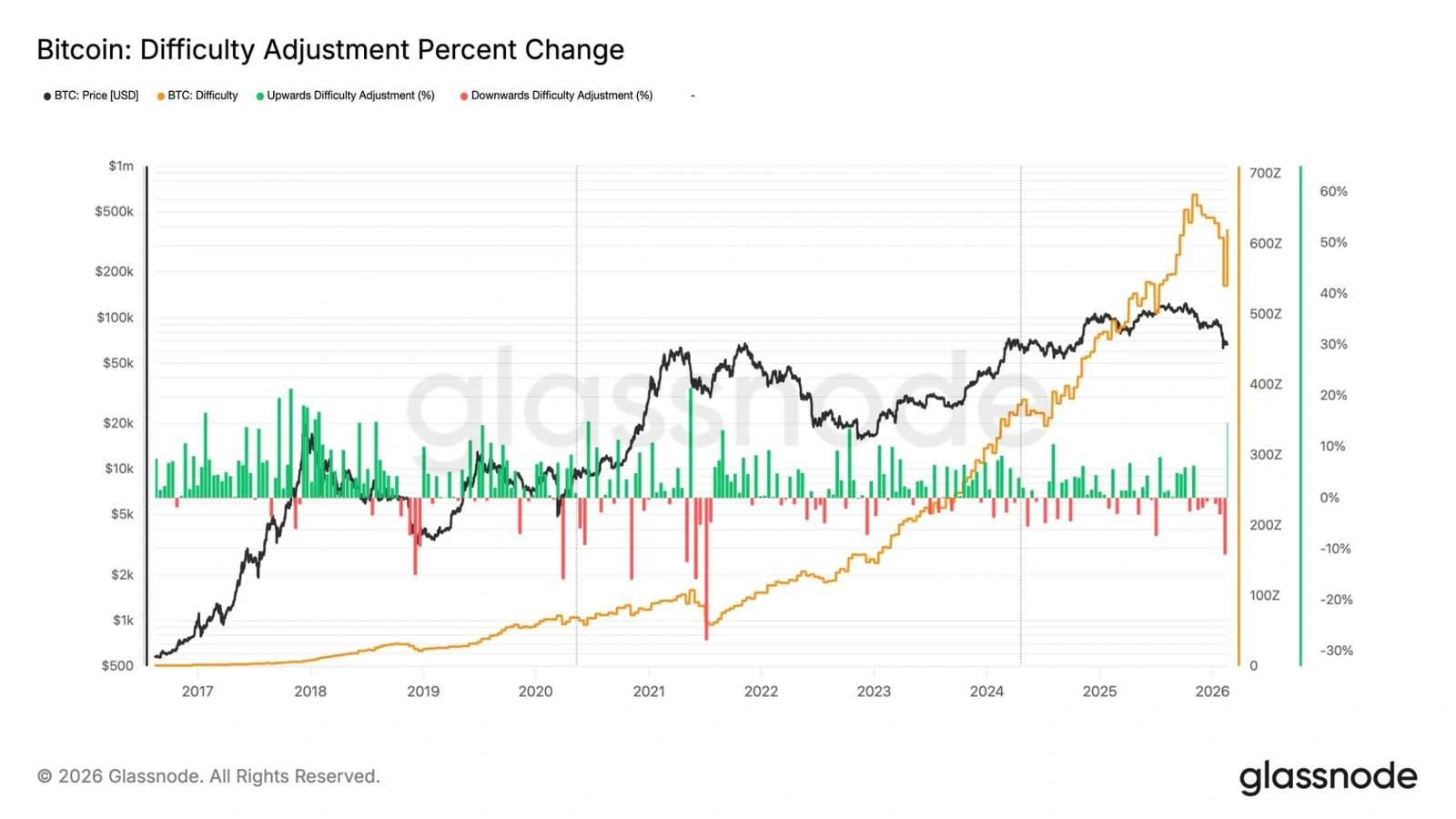

2 Bitcoin mining difficulty spiked 15% to 144.4T, the largest increase since 2021. Hashrate rebounded to 1 ZH/s.

This is the market's weirdest divergence right now. Price is limping. Miners are sprinting. A 15% difficulty jump means miners are plugging machines back in at a pace we haven't seen in five years, even though hashprice is at multi-year lows. Why? Because miners don't trade the next week. They trade the next halving cycle. They're betting that the current price slump is temporary and that being online when the turn comes matters more than today's margins. Think of it like a restaurant hiring extra cooks during a slow Tuesday because they know Friday's coming. The U.S. winter storm had knocked a chunk of hashrate offline, and the snapback was violent. But the signal underneath is clear: the people closest to Bitcoin's infrastructure are not bearish.

If hashrate holds above 1 ZH/s for the next 14 days despite compressed margins, miners are signaling deep conviction. If hashrate drops back below that level, the difficulty spike was just a weather-related snapback, not a trend.

3 Options markets still pricing panic premiums even as Bitcoin bounces above $68,000. Put skew remains elevated.

Price recovered. Sentiment didn't. That's the tell. Options traders are still paying up for downside protection like someone who just survived a car crash and now flinches at every yellow light. The put skew staying elevated while spot bounces means the smart money isn't trusting this move. They're hedging it. And when hedging demand stays high during a rally, it usually means one of two things: either the rally has legs and all that protection becomes fuel for a squeeze, or the hedgers are right and we're just visiting higher prices before heading back down. The fact that funding flipped positive adds a wrinkle. Longs are paying again, which means leverage is creeping back in on the upside. Leverage plus skepticism is a volatile cocktail.

If put skew normalizes within 5 days while BTC holds above $67,000, the panic premium was overdone and shorts get squeezed. If skew stays elevated and price rolls over below $66,000, the options market was right to stay scared.

4 Ripple CEO Brad Garlinghouse says the CLARITY Act has a 90% chance of passing by April. Custodia's Caitlin Long says Trump family crypto ties are complicating it.

Two people who should agree on crypto regulation are telling completely different stories. Garlinghouse is doing a victory lap. Long is waving a red flag. The CLARITY Act would finally draw a line between what's a security and what's a commodity, which is the single most important unanswered question in U.S. crypto. But Long's point at ETH Denver is sharp: the ethics cloud around Trump-linked crypto projects is giving Senate fence-sitters an excuse to slow-walk the bill. A 90% probability from a CEO whose company directly benefits from the bill passing should be taken with a salt mine, not a grain. The real signal is whether Senate Banking actually schedules a vote. Talk is cheap. Floor time isn't.

If Senate Banking schedules a markup session for the CLARITY Act within 14 days, Garlinghouse's optimism has teeth. If the bill stays in committee limbo through March, Long's warning about political complications was the better read.

5 BlackRock bought UNI tokens. Capital is rotating from DeFi yield into tokenized real-world assets.

BlackRock buying UNI is the kind of headline that makes crypto Twitter lose its mind. But zoom out. The bigger story is the rotation happening underneath: capital is leaving DeFi protocols and flowing into tokenized assets. That's not capitulation. That's maturation. When the world's largest asset manager starts buying governance tokens for a DEX, it's not because they want to vote on fee switches. It's because they see DeFi infrastructure as a distribution channel for tokenized everything. Meanwhile, Lido and Chaos Labs are calling this a turning point for institutional DeFi adoption. Maybe. Or maybe institutions are just cherry-picking the protocols that look most like traditional finance and ignoring the rest. Either way, the RWA narrative is eating DeFi's lunch: RWA market cap sits at $51.646B even after a -9.79% weekly pullback.

If UNI price holds or rises over the next 7 days on this news while broader DeFi tokens bleed, the "institutional picks" thesis is real. If UNI dumps with everything else, BlackRock's buy was noise, not signal.

5 Quick Hits

- AZTEC token surges 82% on dual South Korean exchange listings — Upbit and Bithumb both added local currency pairs for the privacy-focused Ethereum L2 token. Thin liquidity plus Korean exchange premium equals fireworks.

- Tennessee judge blocks state enforcement against Kalshi prediction markets — The ruling found sports event contracts likely qualify as swaps under federal law, potentially preempting state gambling regulations. Big win for prediction market legality.

- Parsec, the DeFi/NFT analytics platform, shuts down — Another analytics tool bites the dust amid prolonged market volatility. The crypto data business is brutal when trading volumes dry up.

- Bitdeer stock drops 17% after announcing $300M convertible note offering — Dilution fears hit the mining stock hard. Raising debt at multi-year low hashprices is either desperate or contrarian genius. Probably somewhere in between.

- White House floats limited stablecoin rewards in third crypto-bank meeting — The administration is inching toward letting banks offer yield on stablecoins. If this becomes policy, it's the bridge between TradFi deposits and onchain dollars.

Risk Map

- 🔴 Behavioral: Options panic premium persists despite price bounce: Put skew staying elevated while BTC recovers means the people who pay the most for information (options traders) don't trust this rally. When hedging demand stays high into a bounce, the next leg down tends to be sharper because everyone's already positioned for it, and protective puts get rolled into new strikes.

- 🔴 Structural: ETF outflow streak entering week six with no reversal signal: Five weeks, nearly $4B out the door. ETF flows were the demand engine for the 2024-2025 rally. If the engine stalls for a sixth week, the market loses its marginal buyer. BTC is stuck below the $79K True Market Mean and the only support Glassnode flags is the $54.9K Realized Price. That's a wide, uncomfortable gap.

- 🔴 Wildcard: U.S.-Iran tensions pushing gold higher while BTC lags: Gold is ripping on geopolitical fear. Bitcoin is not. Every cycle, crypto bulls promise BTC will be the safe haven asset. Every geopolitical shock, gold wins that argument. If tensions escalate further, the "digital gold" narrative takes another credibility hit, and risk-off flows bypass crypto entirely.

Catalysts (Next 7 Days)

- 📅 CLARITY Act Senate Banking progress (By end of February): Garlinghouse says 90% chance by April. If Senate Banking signals a markup this month, it's the most significant U.S. crypto regulatory catalyst of 2026.

- 📅 Bitcoin mining difficulty adjustment aftermath (Next 7-14 days): The 15% spike is the largest since 2021. Whether hashrate holds at 1 ZH/s or drops back will tell us if miners are genuinely bullish or just snapping back from storm outages.

- 📅 ETF flow reversal watch (Daily through Feb 27): Week six of outflows would be the longest streak since ETF launch. A single day of $200M+ inflows would break the pattern and likely trigger a short squeeze given elevated put positioning.

Sources

- $4B in Bitcoin ETF outflows over five weeks.... decrypt.co

- Bitcoin mining difficulty spiked 15% to 144.4T, the... coindesk.com

- $4B in Bitcoin ETF outflows over five weeks.... insights.glassnode.com

- $4B in Bitcoin ETF outflows over five weeks.... theblock.co

- Bitcoin mining difficulty spiked 15% to 144.4T, the... theblock.co

- Options markets still pricing panic premiums even as... coindesk.com

- Ripple CEO Brad Garlinghouse says the CLARITY Act... coindesk.com

- Ripple CEO Brad Garlinghouse says the CLARITY Act... decrypt.co

- BlackRock bought UNI tokens. Capital is rotating from... theblock.co

- BlackRock bought UNI tokens. Capital is rotating from... decrypt.co

- api.coingecko.com api.coingecko.com

- api.coingecko.com api.coingecko.com

- api.llama.fi api.llama.fi

- polymarket.com polymarket.com

- polymarket.com polymarket.com

- polymarket.com polymarket.com

Disclosures

Not investment advice. For education only. Crypto is high risk. We may earn affiliate revenue from some links.