If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Lead Change

BTC ETFs bled $133M. Fear & Greed screams Extreme Fear. And the $40K put is now Bitcoin's second-largest options position. Meanwhile, Base just dumped the OP Stack. Someone's rewriting the L2 map.

Market Snapshot

Risk-off across the board. BTC dominance grinding higher as alts bleed faster than majors.

Narratives Snapshot

Almost every narrative is bleeding. Prediction Markets is the lone survivor at +10.73%.

What Prediction Markets Think

Short-term BTC floor confidence is high (89% above $64K tomorrow), but the options market is hedging for much worse. Fed rate expectations lean toward a move by June (60.5% implied probability), which could be the macro catalyst crypto needs, or the disappointment that breaks the range.

Data from Polymarket prediction markets • Prices reflect real-money bets

5 Changes That Matter

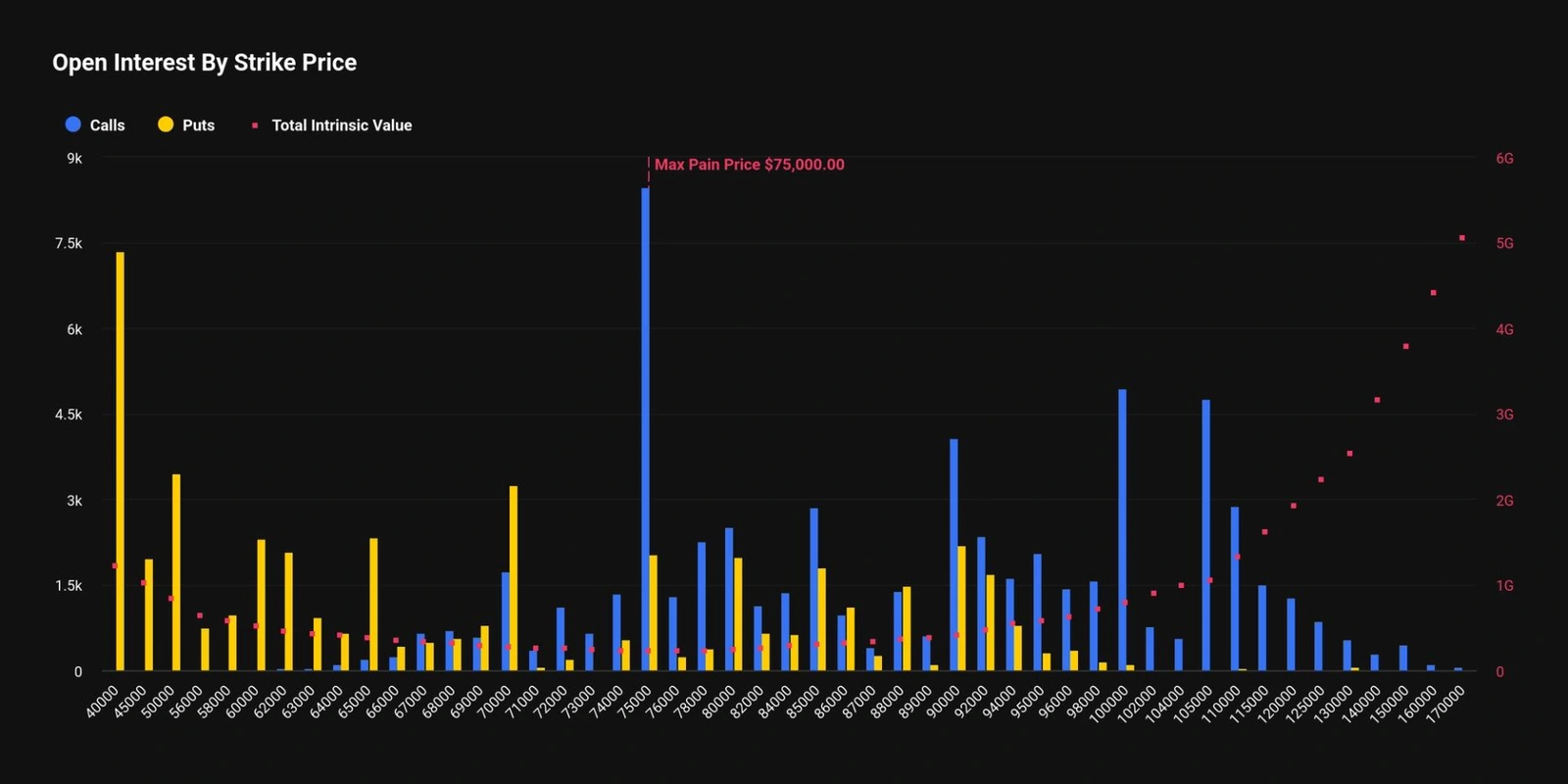

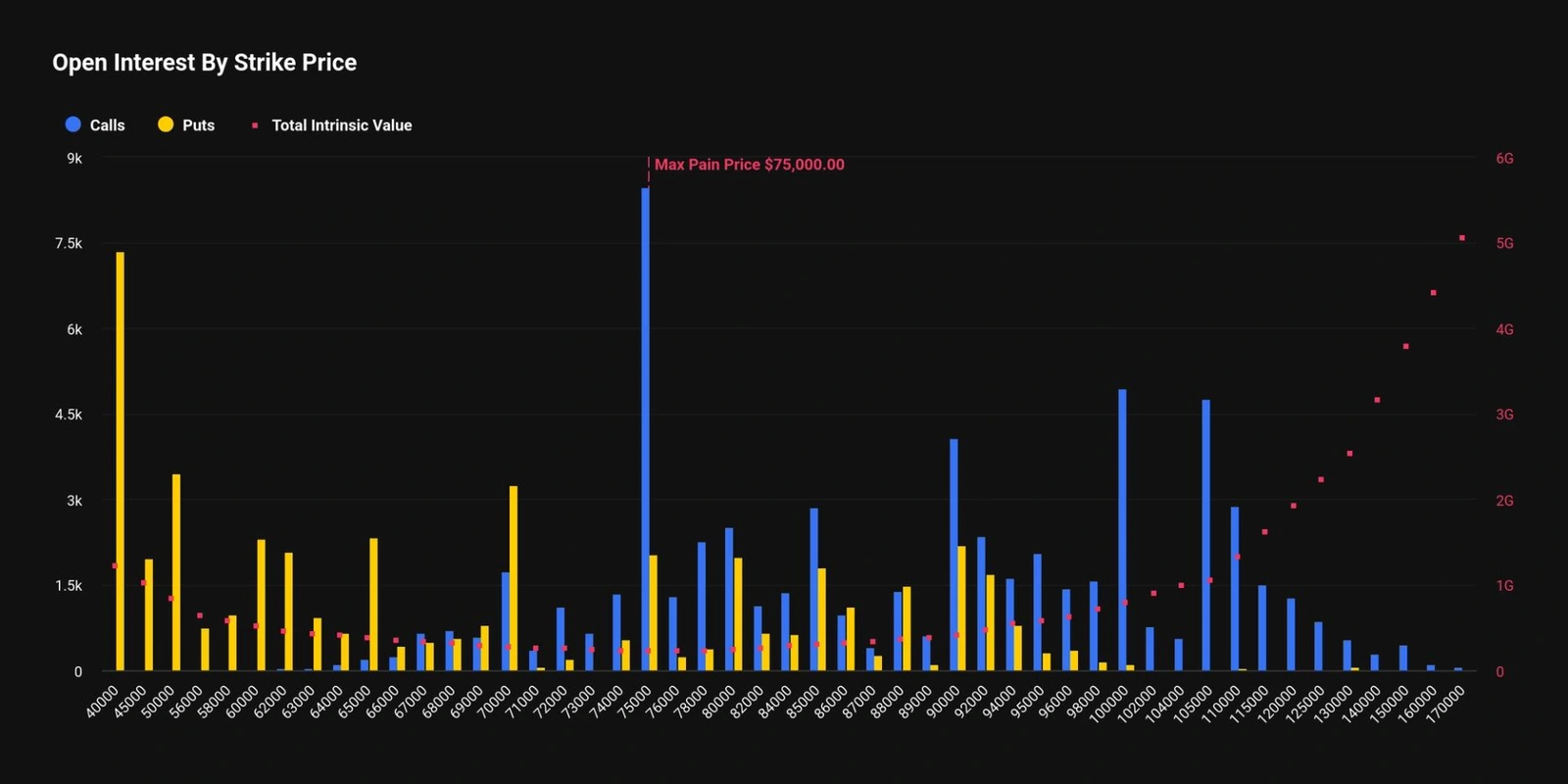

1 Bitcoin's $40,000 put is now the second-largest options position ahead of next week's February expiry. ETFs bled $133M while sentiment sits in Extreme Fear.

Let's put this together. Traders are paying real money to protect against a 40% drawdown from here. That's not a hedge. That's a fire insurance policy on a house that's already smoking. The $40K strike isn't a prediction, it's a positioning tell: the options market is pricing tail risk that the spot market hasn't fully absorbed yet. Combine that with $133M in ETF outflows and Extreme Fear on the sentiment gauge, and you've got a market where the people with the most capital are quietly building lifeboats. Glassnode notes BTC has broken below the True Market Mean around $79K and is now in a defensive range down to the Realized Price near $54.9K. The good news? Extreme Fear has historically been a better entry than exit. The bad news? "Historically" doesn't pay your margin call.

If BTC holds above $65K through the Feb expiry next week while put open interest declines, the hedging was overdone and a relief rally is likely. If it breaks $65K with rising put volume, the $60K level becomes the next magnet.

2 Coinbase is abandoning Optimism's OP Stack for Base, building its own unified tech stack. OP token plunged double digits on the news.

This is the L2 equivalent of your biggest tenant telling you they're building their own apartment complex. Base was the crown jewel of the Superchain thesis: proof that major companies would build on the OP Stack and pay sequencer fees back to Optimism. That thesis just took a sledgehammer. Coinbase's reasoning is straightforward: they think they can ship faster in-house. But the second-order effect is what matters. If the largest OP Stack chain doesn't need the OP Stack, what's the moat? Optimism now has to convince every other Superchain builder that the framework is worth it without its flagship customer. Base TVL sits at $3.8B per DefiLlama. That's a lot of economic activity that just decoupled from Optimism's value capture story. Meanwhile, Arbitrum is pushing its own ZK roadmap. The L2 wars just got a lot more fragmented.

If OP token doesn't recover above its pre-announcement level within 7 days, the market is repricing the Superchain thesis permanently. If other Superchain builders (like Zora, Mode) publicly reaffirm commitment, the damage may be contained.

3 Ledn raised $188M in the first-ever Bitcoin-backed asset-backed securities deal, packaging over 5,400 BTC-collateralized loans. S&P rated the majority BBB-.

A crypto lender just did something that would have been science fiction three years ago: it securitized Bitcoin loans and sold them to traditional fixed-income investors with a credit rating from S&P. This is the TradFi-crypto bridge that everyone talks about but rarely materializes. BBB- is investment grade, barely. It's the financial equivalent of a C+ student getting into a decent college. Not impressive on its own, but it opens the door. If this deal performs, the next one will be bigger and rated higher. If it blows up, it'll set the entire crypto-ABS market back years. The structure matters: these are overcollateralized BTC loans, meaning borrowers posted more Bitcoin than they borrowed. That's a very different risk profile than the unsecured lending that killed Celsius and BlockFi.

If a second BTC-backed ABS deal prices within 90 days at a tighter spread, institutional appetite is real. If this deal trades at a discount in secondary markets within 30 days, the market is saying the rating was generous.

4 Altcoin selling pressure hit a five-year high, with net outflows matching levels last seen in 2021. Solana ETFs bucked the trend with fresh inflows while BTC, ETH, and XRP products all bled.

The altcoin market is doing its best impression of a clearance sale where nobody's buying. Selling pressure at five-year highs means holders who survived the 2022 bear market, the 2023 recovery, and the 2024-2025 cycle are finally tapping out. That's capitulation-grade behavior. Look at the narrative tracker: Memes down -13.23% on the week, AI down -17.08%, DePIN down -19.89%, GameFi down -21.15%. The only narrative in the green? Prediction Markets at +10.73%. People would rather bet on outcomes than hold tokens. That's a sentiment statement. The Solana ETF inflow divergence is interesting though. Institutions are selectively rotating, not running for the exits entirely. They're just getting pickier about which exits they use.

If BTC dominance breaks above 57% this week, the alt bleed accelerates. If it reverses below 55%, rotation back into alts is starting. Watch SOL ETF flows for 3 consecutive days of inflows to confirm the rotation thesis.

5 The Ethereum Foundation published its 2026 protocol priorities: quantum readiness, gas limit increases, and continued L1 scaling alongside blob scaling for L2s.

While everyone's debating whether ETH is "dead," the Foundation just quietly published a roadmap that reads like a to-do list for the next decade. Quantum readiness sounds like overkill until you remember that Google's quantum chip made headlines last year. The EF is essentially saying: we'd rather be five years early on quantum defense than five minutes late. Gas limit increases are the more immediate play. Higher gas limits mean more throughput on L1, which is the Foundation's answer to the "nobody uses Ethereum mainnet anymore" criticism. It's also a direct response to the L2 fragmentation problem. If L1 is cheap enough, some activity comes back home. The timing is notable: this drops the same week Base abandons the OP Stack. The EF is signaling that Ethereum L1 itself needs to be the coordination layer, not any single L2 framework.

If Ethereum's average gas price rises above 10 gwei within 30 days of a gas limit increase, L1 demand is returning. If it stays below 5 gwei, the capacity increase just made an empty restaurant bigger.

5 Quick Hits

- Uniswap governance mulls protocol fees on all V3 pools plus 8 new chains — If passed, this would be Uniswap's most aggressive revenue capture move yet, turning the fee switch on across every remaining V3 pool on Ethereum mainnet.

- Robinhood's L2 testnet hit 4 million transactions in its first week — Built on Arbitrum and targeting tokenized RWAs, Robinhood Chain is the latest TradFi player treating L2s as their on-ramp to onchain finance.

- OpenAI and Paradigm launched EVMbench to benchmark AI agents on smart contract security — The tool measures how well AI can detect, exploit, and patch high-severity vulnerabilities. The intersection of AI and crypto security just got its first standardized test.

- UAE royal family-linked mining wallets hold $344M in unrealized BTC profit — Sovereign-adjacent mining is quietly becoming a thing. The profit figure excludes energy costs, so the real number is lower, but the signal is clear: nation-state-level players are stacking.

- 77% of stablecoin users say they'd open a crypto wallet with their bank — A YouGov/Coinbase/BVNK survey found overwhelming demand for bank-integrated stablecoin wallets and debit cards. Banks that ignore this are leaving money on the table.

Risk Map

- 🔴 Behavioral: Extreme Fear + five-year-high altcoin selling pressure: Sentiment is in Extreme Fear territory while altcoin outflows match 2021 levels. Historically this combination precedes either a sharp bounce or an acceleration lower. The danger is assuming "it can't get worse" when positioning data says it can.

- 🔴 Structural: BTC options skew toward massive downside protection: The $40K put becoming the second-largest options position means sophisticated traders are paying up for crash insurance. When the people who do this for a living are hedging this aggressively, the spot market's calm is misleading. Glassnode's defensive range between $79K True Market Mean and $54.9K Realized Price gives you the battlefield.

- 🔴 Wildcard: L2 fragmentation accelerating after Base exits OP Stack: Base leaving the Superchain isn't just an Optimism problem. It signals that the L2 consolidation thesis is breaking apart. If major L2s all run their own stacks, interoperability gets harder, liquidity fragments further, and the "Ethereum alignment" narrative weakens at the worst possible time.

Catalysts (Next 7 Days)

- 📅 Bitcoin February Options Expiry (Late Feb (next week)): The $40K put is the second-largest position. Max pain dynamics around expiry could force sharp moves in either direction as dealers unwind hedges.

- 📅 ETH Denver 2026 (ongoing) (This week): Builder sentiment at ETH Denver will set the tone for Ethereum's narrative. Early reports say serious interest has replaced hype-driven crowds. Any major protocol announcements here could shift the ETH narrative.

- 📅 Uniswap V3 Fee Switch Governance Vote (This week (proposal stage)): If Uniswap activates protocol fees across all V3 pools, it fundamentally changes UNI's value accrual story and sets a precedent for other DeFi protocols sitting on dormant fee switches.

Sources

- Bitcoin's $40,000 put is now the second-largest options... cointelegraph.com

- Bitcoin's $40,000 put is now the second-largest options... coindesk.com

- Coinbase is abandoning Optimism's OP Stack for Base,... bankless.com

- Bitcoin's $40,000 put is now the second-largest options... insights.glassnode.com

- Coinbase is abandoning Optimism's OP Stack for Base,... decrypt.co

- Ledn raised $188M in the first-ever Bitcoin-backed asset-backed... coindesk.com

- Ledn raised $188M in the first-ever Bitcoin-backed asset-backed... cointelegraph.com

- Altcoin selling pressure hit a five-year high, with... decrypt.co

- Altcoin selling pressure hit a five-year high, with... coindesk.com

- The Ethereum Foundation published its 2026 protocol priorities:... cointelegraph.com

- The Ethereum Foundation published its 2026 protocol priorities:... blog.ethereum.org

- ETH Denver 2026 (ongoing) decrypt.co

- Uniswap V3 Fee Switch Governance Vote theblock.co

- api.coingecko.com api.coingecko.com

- api.coingecko.com api.coingecko.com

- api.llama.fi api.llama.fi

- polymarket.com polymarket.com

- polymarket.com polymarket.com

Disclosures

Not investment advice. For education only. Crypto is high risk. We may earn affiliate revenue from some links.